Exploring Finance options online can be daunting but we’re here to help you find the right arrangement for you, be it Hire Purchase (HP) , Personal Contract Plan (PCP) or an alternative.

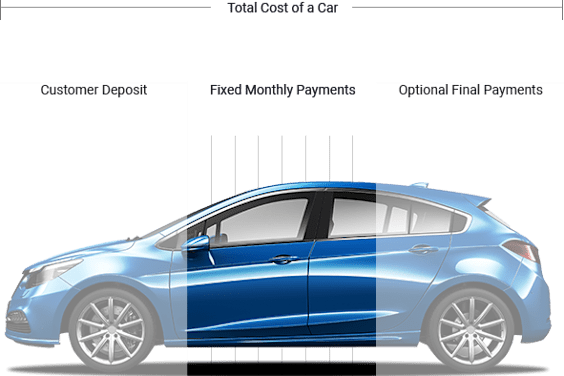

What is Personal Contract Purchase (PCP)?

This option is generally better for people who like to change their car regularly.

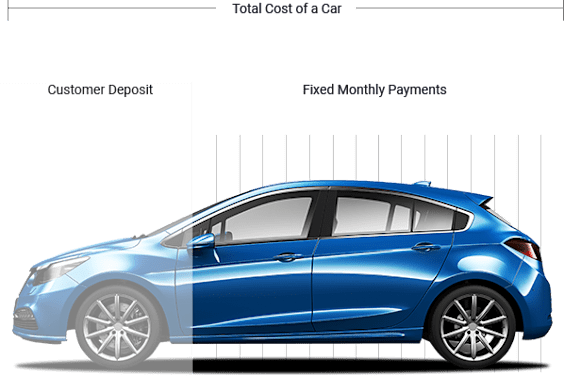

This option is generally better for somebody who wants to own the vehicle at the end of the agreement and can afford to pay more per month. If you don't have a high credit score, a hire purchase agreement may be easier to obtain as the car is used as collateral for the loan.